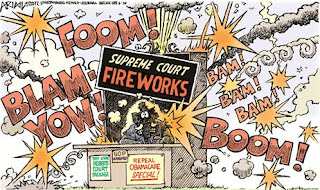

What’s New Today

Story #1 is

the story gives you five silver linings for the survival of Obamacare. #2 lists the seven tax hikes associated with

Obamacare. #3 lists the 10 worst things about Obamacare. #4 looks at the Robert’s decision to see if

it is a benefit or a tax to those who are opposed to it. #5 links you to a viral video of the

Obamacare decision. #6 is Mickey Klaus’

look at the future for Obamacare and specifically can it be repealed.

Today’s

Thoughts

“It

is not our job to protect the people from the consequences of their political

choices.” Chief Justice

John Roberts on Obamacare So elections do

have consequences.

As we start looking at Obama’s achievements, the

successful completion of the relief well (Deep Water Horizon) was on September 17, 2010 some 148 days

after the disaster occurred.

1. Five Possible Silver Linings in the Obamacare Ruling

I have not been as overwhelmed with grief at the Supreme Court’s decision on the Affordable Care Act as some of my fellow conservatives. I was wondering whether I was just being naive, but since I just listened in person to a talk from Paul Clement, who actually argued the case on behalf of the states before the Supreme Court, and his feelings seemed to resonate with my own, I feel a little more confident now to share what might be some of the silver linings in this decision…:

http://www.patheos.com/blogs/philosophicalfragments/2012/06/28/five-possible-silver-linings-in-the-obamacare-decisio/

Cutting to the chase the five silver linings are 1) it pushes new power grabs out of the commerce clause and into the taxing power and tax laws are more difficult to pass, 2) as a tax it will be easier to repeal (no filibusters allowed), 3) the state can now back out of the Medicaid expansion, 4) the Democrats now own the most deceptive tax hike in history, and 5) this focuses the election on whether the government should have more power over the individual or less.

2. Obamacare’s 7 tax hikes on people earning under $250,000

By ruling that ObamaCare is

constitutional, the Supreme Court has set in motion a slew of tax hikes. Well,

someone has to pay for it. For rich

folks, looming big is the 3.8% Medicare surtax on investment income, and the

0.9% Medicare payroll tax hike (from 1.45% to 2.35%). And then there are the

tax hikes for everybody else.

Obama’s pledge against any form of tax increase on Americans

making less than $250,000 a year “was thrown out the window” when he signed the healthcare law, says John Kartch,

communications director with Americans For Tax Reform (founded by anti-tax

crusader Grover Norquist).

Here’s

a rundown of seven ObamaCare tax hikes that affect the hoi polloi…

Another promise broken.

Here’s a list of 20 tax increases by the Obama Administration.

Now, all the rest of us are going to find out a lot more about what’s in the 2,700-page health overhaul law.

The president now must spend the next four months defending a law that the majority of Americans dislike, and the more they learn about it, the more they dislike it. Worse, the part of the law that is the least popular — the individual mandate — has now been declared a tax.

That’s double jeopardy for the president: The unpopular mandate stands, and it is called a tax. Either the president admits it’s a tax as a way of keeping the law on the books, or he says that the Supreme Court is wrong, that it’s not a tax, in which case his law would be invalid….

…Here’s a quick checklist of the ten worst things in the law — in addition to the individual and Medicaid mandates:

1. Employer mandate. Most companies will have to provide and pay for expensive government-determined health insurance for their employees or face federal fines.

2. Anti-conscience mandate. Religious organizations will be required to provide free sterilization, contraceptives, and abortion-inducing drugs to their employees, even if it violates their religious beliefs.

3. New and higher taxes. The law contains at least 20 new taxes totaling $500 billion that will hit medical innovators, health insurance, and even the sale of your home.

4. The Independent Payment Advisory Board. IPAB will still stand, with its rationing power over Medicare.

5. State exchanges. States will be compelled to set up vast new bureaucracies to check into our finances and families so they can hand out generous taxpayer subsidies for health insurance to families earning up to $90,000 a year.

6. Medicare payment cuts. $575 billion in payment reductions to Medicare providers and Medicare Advantage plans will cause more and more physicians to stop seeing Medicare patients, exacerbating access problems.

7. Higher health-care costs. The Kaiser Family Foundation says the average price of a family policy has risen by $2,200 during the Obama administration. The president promised premiums would be $2,500 lower by this year. Hospitals, doctors, businesses, and consumers all expect their taxes and health costs to rise under Obamacare.

8. Government control over doctor decisions. Value-based payments, quality reporting requirements, and government comparative-effectiveness boards will dictate how doctors practice medicine. Nearly half of all physicians are seriously considering leaving practice, leading to a severe doctor shortage.

9. Huge deficits. The CBO has raised its cost estimate for the law to $1.76 trillion over ten years, but that is only the opening bid as more and more people lose their job-based coverage and flood into taxpayer-subsidized insurance. At this rate, the cost will be $2 trillion, not the less than $1 trillion the president promised.

10. 159 new boards, agencies, and programs: The Obama administration will work quickly to set up as many of the law’s new bureaucracies as fast as it can so they can take root before the election.

This will be playing out over time and offers Romney plenty

of fodder to use in the coming election.

4. Robert’s ruling a Benefit or a Tax?

OK, it’s hard to admit but my initial

reaction to this morning’s Obamacare decision by the Supreme Court – a snide

tweet branding Chief Justice John Roberts as another “gift” from

President George W. Bush like the Medicare Prescription Drug benefit program –

was embarrassingly hasty.

After reading and stewing about it

all day, I’ve concluded that what

Roberts has done is fundamentally shift the constitutional debate away from the

liberal assumption since the Woodrow Wilson era that an Imperial Presidency

and supine Congress can pretty much do

as they please so long as it’s covered by at least one of those fig leaves

known as the General Welfare, Necessary and Proper or Commerce clauses of the

Constitution.

The new assumption is, thanks to

Roberts, that at least two of those clauses in fact cannot simply be dragooned

into the service of whatever a passing majority in Congress wants to do. And

having shifted the meaning of those two clauses, courts will likely now have to

view the other clause differently as well.

In other words, the Constitution means something today that it didn’t yesterday, at

least in terms of constitutional precedent. It’s not a grand rout of

liberalism from the field of battle, but the correlation of constitutional forces has now shifted under

their feet in such a way that they must

go over to the defensive on ground not of their choosing.

Further, the holding that Obamacare

passes constitutional muster if it is understood as a tax may be an even more

significant victory for conservatives. To understand why, which of these two

words sounds more positive? “Benefit” or “tax”? Who is more likely to prevail – the advocate offering a positive

benefit without having to explain in any detail how it will be funded, or the

advocate who right out front says your taxes have to go up but, trust me,

you’re going to love this new benefit?...

This is probably the best silver lining I’ve read about since

the verdict on Obamacare was written.

Precedent is a powerful force and Roberts has changed the precedents not

to the liberals benefit. In fact they

will now be taxed with the responsibility to telling people not only the

benefit but the cost.

5. Viral Video on ObamaTax

Expect to see a lot more like this. I especially thought “not any of your

taxes. You will not see your taxes go

up.” Barack Obama was particularly

effective.

6. Mickey Klaus on the Repeal of Obamacare

But reconciliation wouldn’t work

here—the process

can only be used for policies that have budgetary effects and a C.B.O. score.

Much of the A.C.A., such as the insurance exchanges and subsidies, would fall

under these categories. But a lot of it, including the hated individual

mandate, does not. Repealing the

exchanges and subsides without repealing the mandate and the other regulations

and cost controls in the law would create a health-care Frankenstein that a

President Romney would be rather nuts to support.

Maybe the exchanges themselves wouldn’t be reconcilable, but if Romney could get rid of the mandate and the subsidies the exchanges would be stripped of their power as a vehicle to ensure universal coverage. Obamacare would effectively be repealed.

Frum,** for his part, thinks politics will preclude repeal even before the main parts of the Act kick in in 2014:

[E]ven

if Republicans do win the White House and Senate in 2012, how much appetite

will they then have for that 1-page repeal bill? Suddenly it will be

their town halls filled with outraged senior citizens whose

benefits are threatened; their incumbencies that will be threatened

Again, huh? Senior citizens already have Medicare. They hate Obamacare, in part because it came packaged with Medicare cuts. Why would they storm town halls to protest its repeal?

Facts are not things the left really likes to look at if it goes

against them. I thought Frum’s comments

about senior citizens filling town halls with because their benefits are

threatened is true. But it will be

Democrats town halls, not Republicans for the reasons Klaus outlined here.

No comments:

Post a Comment